Real Property Gains Tax RPGT Rates. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

. Gallery Real Property Gain Tax RPGT 2019 Latest News and Update. 6 rows What is Real Property Gain Tax RPGT. Fast forward 10 years later Malaysian citizens or permanent residents who disposes of his or her property within the first five years of acquiring it is subject to RPGT.

Budget 2019 will mean higher entry and exit costs for investors which makes the market slightly less appealing. If you owned the property for 12 years youll need to pay an RPGT of 5. A chargeable gain is the profit when the disposal price is more than purchase price of the property.

Real Property Gain Tax RPGT 2019. Disposal by a company Rates of RPGT 010407 311209 Exemption period wef. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. On the First 2500. Higher Costs For Investors.

Real Property Gains Tax RPGT Rates. Based on the Real Property Gain Tax Act 1976 RPGT is a tax on chargeable gains derived from disposal of property. Real Property Gain Tax RPGT 2019.

Malaysian citizens and permanent residents. Salient details are outlined. On the First 35000 Next 15000.

On the First 5000 Next 5000. There are people who see tax as a great equalizer that RPGT is a necessary evil to curb. Among the measured announced there is one to me that stood out the most.

The Real Property Gains Tax Exemption Order 2018 PU. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. PwC TaXavvy Issue 7-2018 4 Revised Real Property Gains Tax RPGT guidelines The IRB has issued a revised RPGT guidelines dated 13 June 2018 2018 Guidelines which has incorporated the changes made to the RPGT Act 1976 since the last RPGT Guidelines dated 18 June 2013 2013 Guidelines was issued.

RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal of a chargeable asset other than shares from 1 January 2019 see Tax Alert No. Reference can be made to the RPGT Guidelines dated 13062018 or 18062013 whichever is applicable.

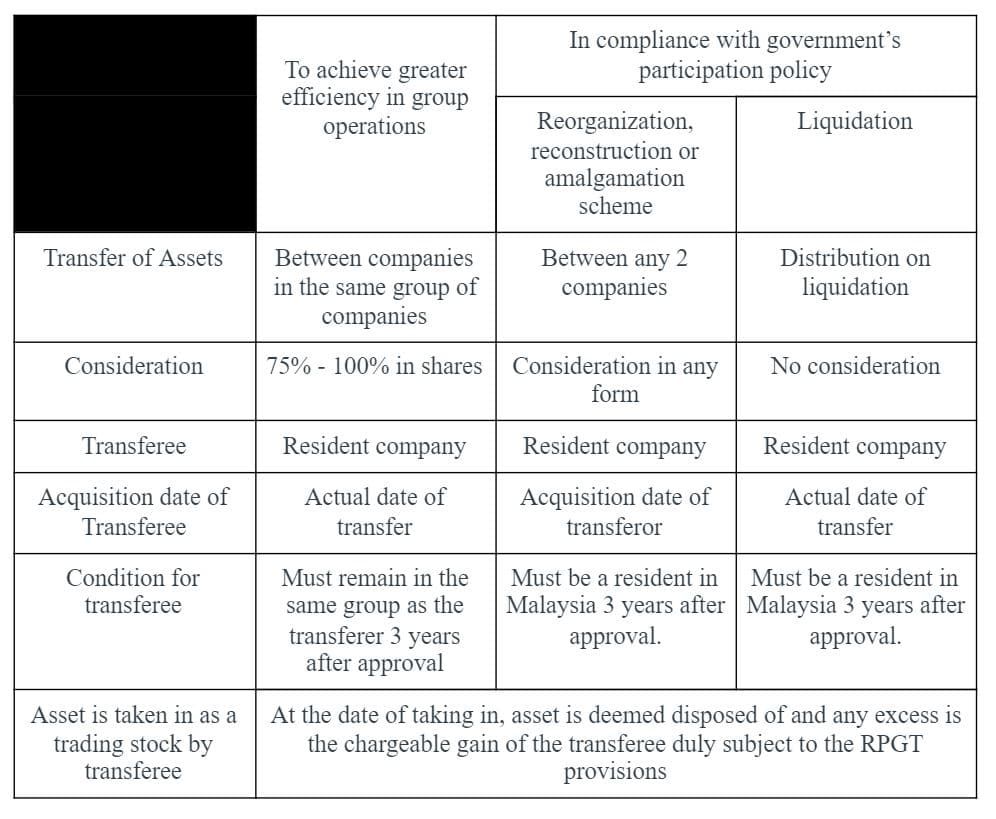

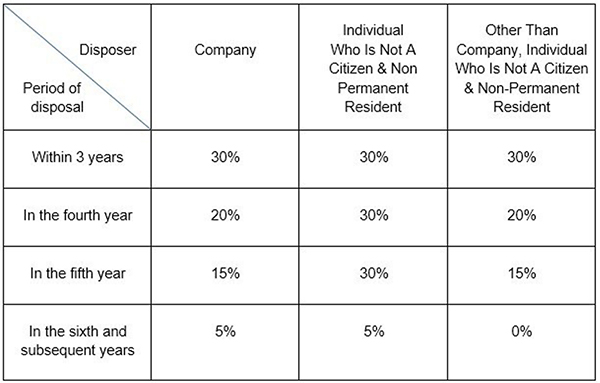

It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them. Disposal Date And Acquisition Date. 31 4 RPGT rates Shows the rates applicable to the following disposers.

Miss As RPGT RM300000 X RPGT Rate which is determined by the number of years shes owned the property as well as her citizenship status within Malaysia. November 2 2018 It would make more sense for the government to increase the Real Property Gains Tax RPGT rates within the first five years instead of imposing a 5 tax rate for Malaysian individuals after the fifth year said the Association of Valuers Property Managers Estate Agents and Property Consultants in the Private Sector Malaysia PEPS. Rate TaxRM 0 - 2500.

Individuals Citizens Permanent Residents Individuals Non Citizens Individuals Citizens Permanent Residents Individuals Non Citizens Within 3 years. REVISED GUIDELINES ON REAL PROPERTY GAINS TAX RPGT The Inland Revenue Board of Malaysia LHDNM has issued the above Bahasa Malaysia version only on 13 June 2018 which replaces the RPGT Guidelines dated 18 June 2013. On the First 50000 Next 20000.

Malaysian citizens will be subject to RPGT at the rate of 30 for a holding period up to 5 years and 5 for a holding period exceeding 5 years. Assets defined situated in Malaysia. Tax Rate Corporate tax rates for companies resident in Malaysia is 24.

2 Non-citizens and non-permanent residents and companies not incorporated in Malaysia 3 - Society registered under the Societies Act 1966 wef 1 January 2022 consists of body of persons registered under any written law in Malaysia 4 - RPGT rates for disposals made in the 6th year and subsequent years reduced to 0 wef. On the First 20000 Next 15000. The Real Property Gains Tax RPGT is tax on profits made from the sale of real.

The RPGT rate for a non-Malaysian citizen is 30 on the gain if the property acquired is less than five years old and 5 on the gain if the property acquired is more than five years old. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. RPGT applies to both residents and non-residents.

It was suspended temporarily in 2008-2009 and reintroduced in 2010. However with the new section effective 1 January 2018 if the property seller is not a Malaysian citizen or not a Malaysian permanent resident the buyer. In the 6th year and subsequent years.

Criteria on Incomplete ITRF. It is a positive move towards a higher home ownership rate among Malaysians in the future. The government has proposed increasing stamp duty from 3 to 4 for the sale of properties priced more than RM1 million.

RPGT is a tax chargeable on the profit gained from the. RPGT rates for property sold within three years and on its fourth and fifth years remain fixed at 30 20 and 15 respectively. Home rpgt 2018.

The Real Property Gains Tax Exemption Order 2018 PU. In the 5th year. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be.

On the First 10000 Next 10000. Youll pay the RPTG over the net chargeable gain. Old RPGT Rates.

Return Form RF Filing Programme. Effective 1 January 2019 the rates of RPGT for property sold after five years is 5 for Malaysians and 10 for foreigners. This makes buying high-end properties a lot more expensive and for investors making.

In this case thats a 20 RPGT rate so the tax is RM60000. In the 4th year. The following are the rates of RPGT for the following 3 categories.

Key Changes In The Real Property Gain Tax Cheng Co Group

What We Need To Know About Rpgt

An Insight Into Real Property Gains Tax Rpgt Properly

How The New Rpgt Ruling Is Affecting The Rakyat

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Understanding Rpgt Legally Malaysians

Real Property Gains Tax After Death Rockwills Info

An Insight Into Real Property Gains Tax Rpgt Properly

Guide To Malaysian Real Property Gain Tax Rpgt

Zerin Properties Real Property Gains Tax

Is 5 Rpgt A Tax On Inflation Part 1 Propsocial

What Is Real Property Gains Tax The Malaysian Bar

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Comprehensive Measures Needed For Property The Star